Seller's Lowering Prices according to Zillow's October Market Report

Grant Brissey

OCT 19, 2023

3 MINUTE READ

Buyer pessimism may have hit a new high in September, according to Fannie Mae’s National Housing Survey, but seller actions, opportunities, and sentiment could lead to more movement than expected over the winter — even as mortgage rates hit levels not seen since the year 2000. We spoke with Zillow economists on the trends that are shining some light in the slow season.

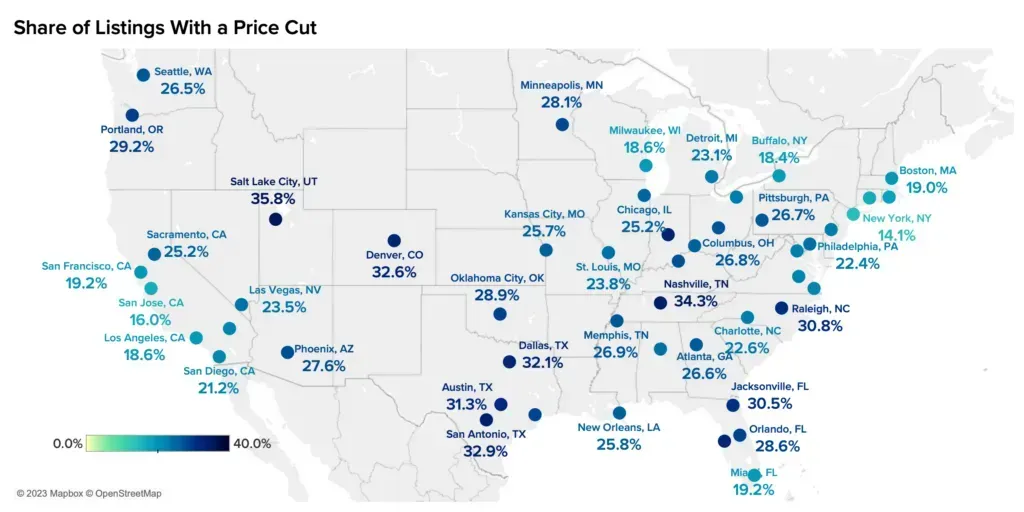

Seller's are cutting at 'unusually high' rates

Share of listings with a price cut as of September 2023.

Key Stat: The weekly share of listings with a price cut climbed to 9.2% the week of September 16.

“Sellers get anxious that they missed the summer tide of demand,” says Zillow Senior Economist Jeff Tucker. “So they try to revive interest with a price cut before demand slips further away.”

This wasn’t a one-time blip either. Some 9% of listings have received a price cut every week since mid-September. The 9.2% number marks the highest share of price cuts since November of last year.

This fall’s price cuts mean either buyers have pulled back, sellers have overreached with too-high list prices, or some combination of the two, Tucker says.

Takeaway: Buyers who can afford the rates can find opportunities with sellers who don’t want to hold onto a home for the winter.

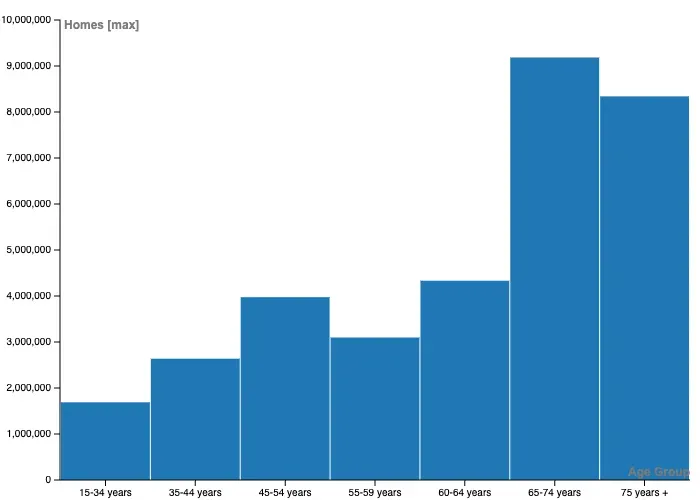

Downsizers and equity-holders can win in this market

Key Stat: Nationally, Baby Boomers and older generations own 21.9 million homes that do not carry a mortgage.

The median sales price of a home grew from $268,100 in Q2 of 2013 to $416,100 in Q2 of 2023. That’s a 55.2% return. (Try getting that from the stock market.) While that return was even more striking in 2022, the fact remains that there’s been a major shift in home equity in the last decade, punctuated by the pandemic.

Combined with the rapid rise in rates, that shift has benefited home-equity holders and near-future downsizers greatly. “What happened with home values and equity over the last three years was rather stunning, and in ways was like winning the lottery,” says Zillow Chief Economist Skylar Olsen. “If you got into the right market at the right rate, you’ve likely built equity faster than you might have expected.”

You’re especially lucky if you’re looking to downsize, says Olsen. Homeowners who own their homes outright can capitalize on the elevated values and the lack of competition created by high mortgage rates. Even those who still owe on a mortgage can downsize and potentially lower their principle and monthly payments.

Homes owned outright by age group, as of 2022.

Takeaway: Homeowners with strong equity aren’t as sensitive to high mortgage rates. Folks in your sphere who’ve recently become empty nesters, want to be closer to family, or just want less home to maintain all land in the group.

Home prices finally fall

Key Stat: The typical U.S. home value fell 0.1% from August to September.

Takeaway: Homes values in some areas that saw the biggest run-ups during the pandemic are still coming down from orbit. In Austin, for example, values are down 10% from a year ago, and in Phoenix they’re down 4.2%.

Read more blogs by

Grant Brissey

or check back here for next month's Market Update brought to you by Zillow!

Follow Me! Let's Connect!